We don’t yet know exactly how the new National-led coalition government will be formed. But we do know that National pledged to make some major changes to tax if it came into power. As a Kiwi Business owner, it is important to stay in the loop of these changes. Things like the shifted income tax brackets, restored interest deductibility, the two-year bright line test and FamilyBoost may impact you. Here is a summary of what you can expect:

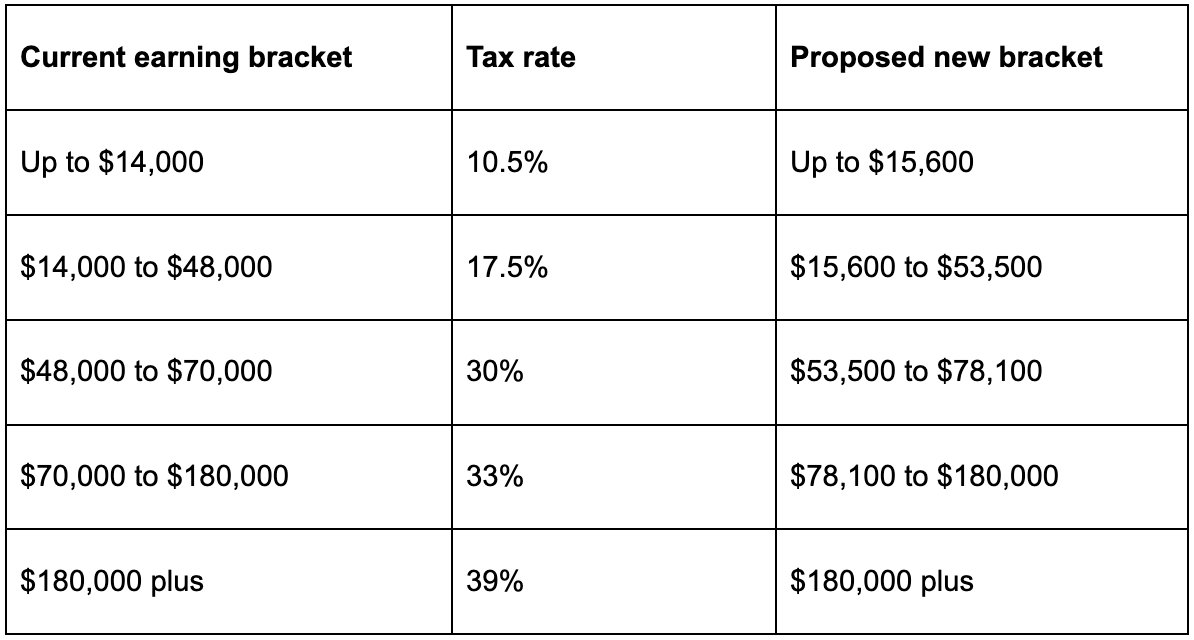

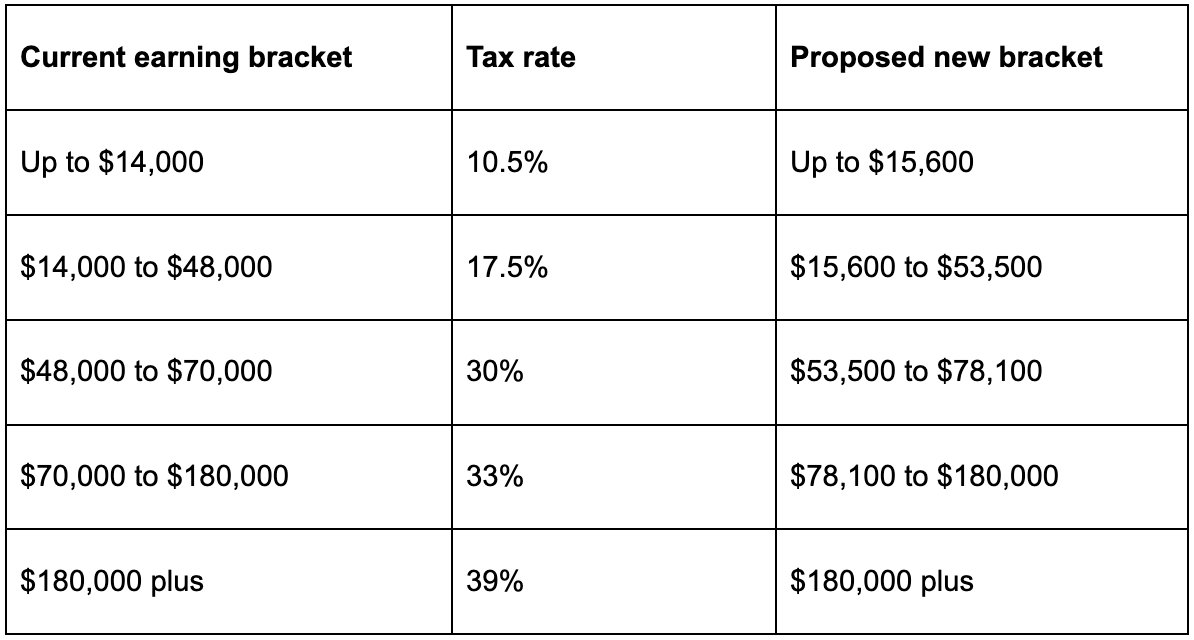

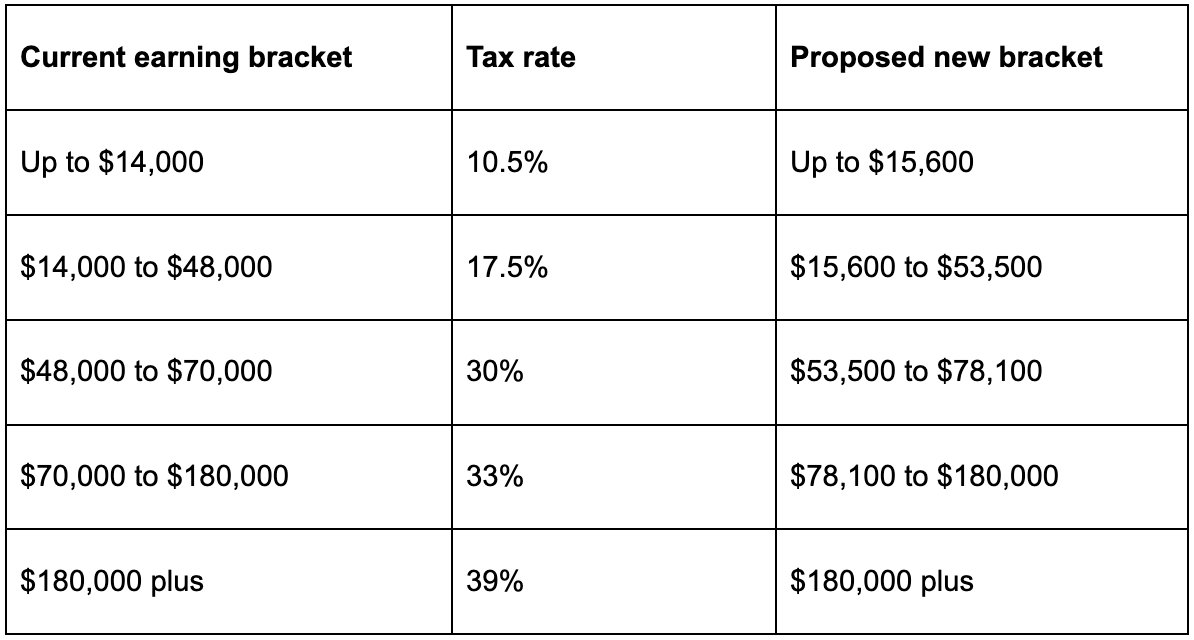

Tweaks to tax brackets

National has proposed changes to tax brackets, designed to adjust for inflation and boost incomes:

Restored interest deductibility on rentals and a two-year bright-line test

On investment properties, National has said it will gradually reinstate 100% interest deductibility. This will happen in increments over the next three years. The bright-line test, which is currently set at 10 years, would be reduced to two years.

FamilyBoost and Working for Families

FamilyBoost is a new initiative that would provide a rebate for childcare costs of up to $150 a fortnight, reducing for higher incomes.

National has also proposed an increase to the existing Working for Families in-work tax credit. Together with the new tax brackets, National says a couple with young children, with a household income of $120,000, would have up to $250 a fortnight more in hand.

No more clean car discounts

National says the clean car rebate and feebate system will be scrapped at the end of 2023. Instead, the party plans to support the transition to EVs by expanding the public charger network, adding 10,000 extra charging stations by 2030.

You can read more about National’s tax plan here.

ACT and NZ First may yet have their say on taxes

In addition to changes mentioned above, ACT has its own tax plan which includes a two-bracket income tax system. It is important to note that the party will have an influence on the final decisions regarding tax brackets and rates, so further changes are expected. It’s also not yet clear whether National and ACT will need to strike a deal with New Zealand First, but if they do it may mean further negotiations on tax changes.

We’ll keep you posted on the changes that will impact you

In conclusion, our team of Business Advisors will be watching closely as the new Government makes decisions on taxes. We’ll keep you updated on changes that may impact you. In the meantime, if you have questions or concerns about what new taxes could mean for you, your trust, or your kiwi business, we’re here to help.

Drop us a note or give us a call, we’d love to hear from you.

No comment yet, add your voice below!