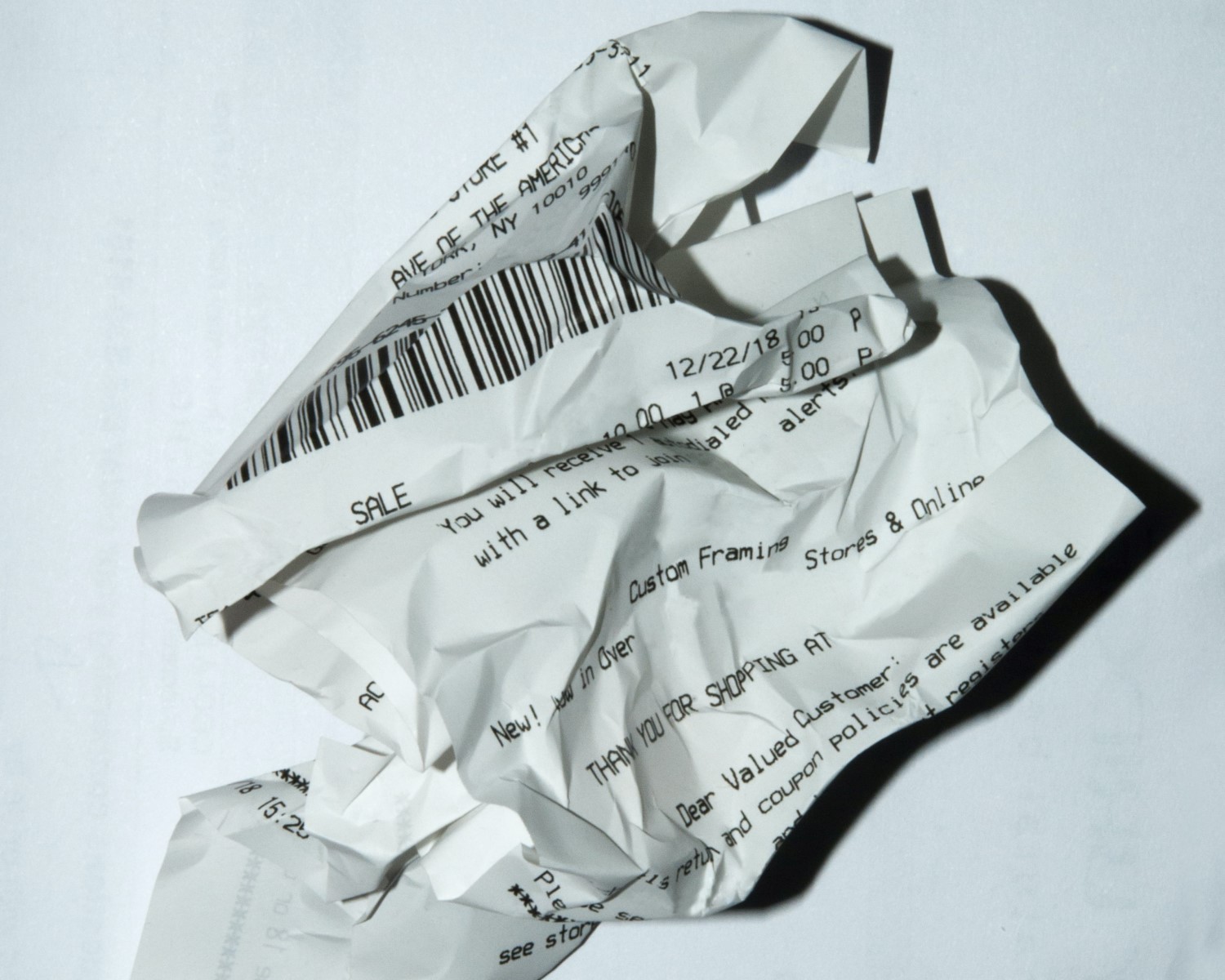

Upcoming GST changes mean no more piles of receipts and invoices are required! Thus, dealing with GST invoice records will be much simpler under Inland Revenue’s new rules, which come into effect on 1 April, 2023. Ultimately, the goal is to modernise your record-keeping systems, which means you’ll be able to get closer to a completely paperless business.

Physical paperwork or PDFs are no longer required

From April next year, you won’t need to keep a physical copy of a tax invoice, a credit note or a debit note. The taxable information you supply can be digital and included in:

- the accounting software that you use, like Xero, or

- your transaction records, or

- in your contractual information.

Also, new wording is coming into use. GST changes will also mean that you no longer need to label your invoices as “Tax invoice”. Instead, the new wording is “Taxable supply information”, but you don’t need to specify that on any invoices. It’s just the Inland Revenue’s way of explaining that certain information needs to be included in the documentation, but you don’t need to make any alterations.

In summary, these changes are necessary to make e-invoicing legal. Without any actual paperwork or even a PDF moving around, your system-to-system invoices will still be valid.

We’re here to help

If you’re not sure which records you need to keep, give us a call or drop us a note. One of our experienced Business Advisors can chat with you about how these changes might impact your business, and how you can use e-invoicing to reduce your risk of invoice fraud. Get in touch!

Together we can achieve more!

No comment yet, add your voice below!